Nvidia once again beat revenue and earnings estimates. The numbers were solid yet the stock fell. Investors focused on weaker datacenter sales and a cautious outlook especially for China where Nvidia expects zero revenue. That was not the kind of message markets were hoping for.

Dell dropped nearly 9 percent after results and Marvell fell by almost 19 percent despite posting a profit.

The takeaway is that the leading group of chipmakers is beginning to show cracks. Nvidia and its peers have carried the sector but the limits of this growth story are starting to appear.

China continues to support domestic leaders like Huawei and Alibaba. With strong backing at home these firms are gaining momentum. Alibaba surprised with a 13 percent rally after reporting results and unveiling a new AI chip.

For American rivals this creates headwinds. They have the talent and technology but limited access to the Chinese market works against their growth prospects.

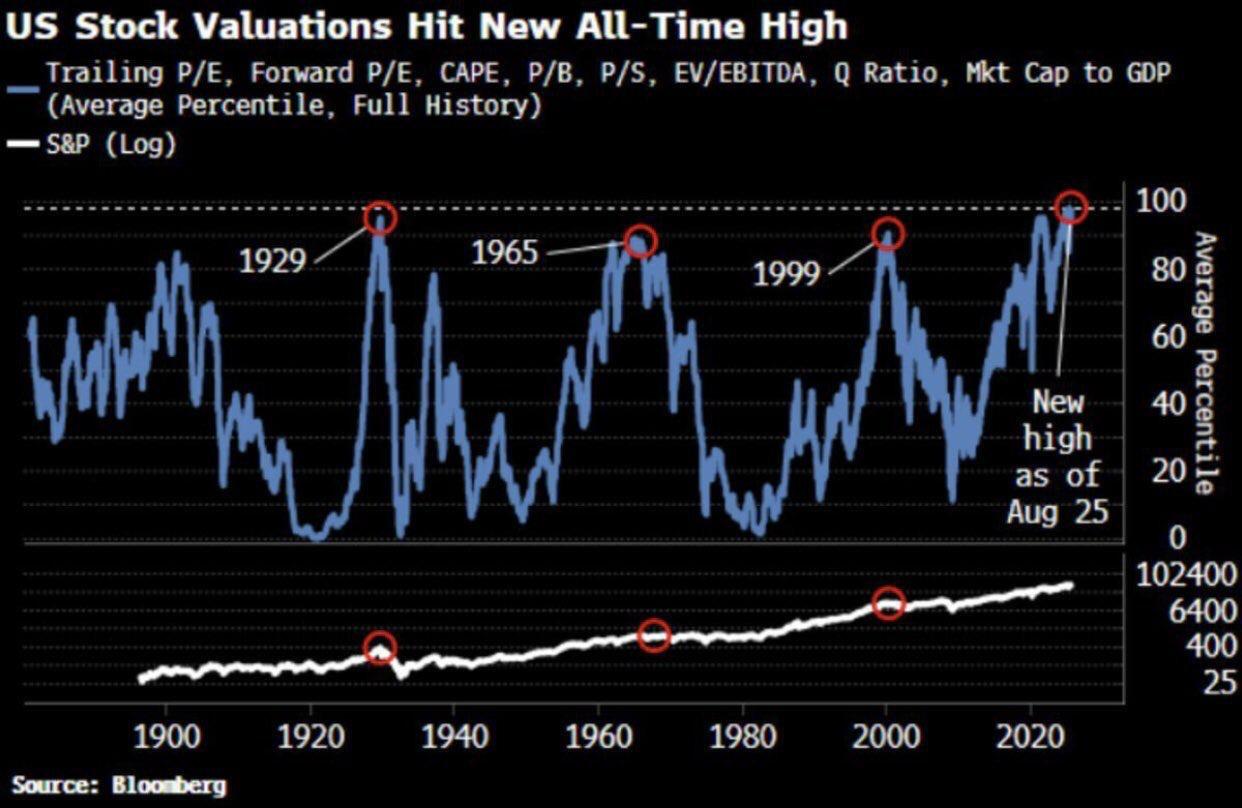

The S&P 500 is trading at more than 23 times forward earnings a level reached in only about 7 percent of the past four decades. The price to sales ratio near 3.23 is higher than during the dot com bubble and the P/E of 23 is well above the long term average of roughly 17.

History suggests that extreme valuations tend to lead to weak future returns. Current estimates point to annual gains of between minus 2 and plus 2 percent when the market runs this hot.

Chart: US stock valuations are now at an all time high higher than in 1929 1965 or 1999 periods that were followed by weak or negative returns. (Source Bloomberg)

Silver has broken above 40 USD and continues to attract investors. As a non yielding safe haven it benefits from expectations of rate cuts.

The Fed is stuck it wants to cut rates but inflation is still around 3 percent. A rate cut here could send a troubling signal that something is structurally wrong. Markets rarely take that well which is why we continue to hold silver.

September is statistically the worst month of the year for equities. This time we enter it with stretched valuations questions around AI China’s push for its own tech champions and a fragile geopolitical backdrop.

We do not chase extremes. We stay focused and patient. In the end markets always return to rationality.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Investments in financial markets carry risks and it is important to conduct your own analysis before making any investment decisions.