Every year looks the same at first glance. Shopping malls are full, Black Friday banners are everywhere and online stores report record sales. It creates the impression that the consumer is in excellent shape and the economy is running without a single hiccup. Yet while people are queueing outside stores, the data shows a very different picture. Debt stress is rising quickly, especially in auto loans, and most notably in used cars financed with expensive credit.

Black Friday and the holiday season create an optical illusion of a strong consumer. The headline numbers show sales, but not who is spending, at what cost and with what debt behind it. In reality the situation is far more divided.

Today several factors overlap at the same time:

• high inflation from past years that has eroded household savings

• the highest interest rates in more than a decade

• record prices of cars, both new and used

• loan payments that are no longer comfortable but borderline

• aggressive marketing that pushes emotional urgency such as now or never, last chance, deal of the year

The result is a bifurcated world. Higher income households can handle Black Friday and the holidays with ease. Lower income households are running at the limit. And that is exactly where we see repayment capacity breaking, first in auto loans and only later in broader consumption.

The auto loan market in the United States is one of the most sensitive indicators of what is happening at the lower end of the consumer spectrum. And this is precisely where we see the biggest cracks. An auto loan used to be the last bill an American family would stop paying. In 2025 it is starting to break right here.

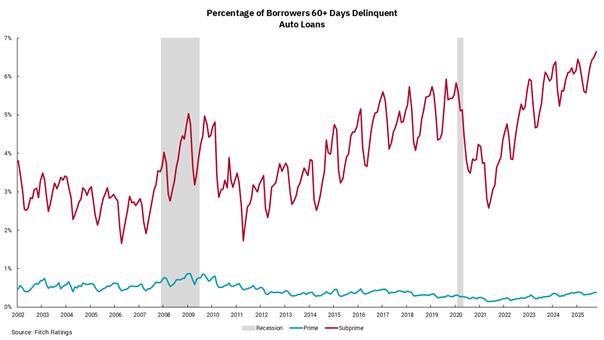

The average price of a new car has moved above fifty thousand dollars and auto loan interest rates typically sit around nine percent. Subprime borrowers are often paying eighteen to twenty percent. Payments are at the highest levels in modern history and the number of households unable to keep up is rising fast.

Hard data shows how serious the situation is:

• subprime auto delinquencies over sixty days past due are around 6.6 to 6.7 percent, the highest level in modern history

• according to VantageScore auto loan delinquencies have risen by more than fifty percent compared to 2010

• the volume of troubled auto loans exceeds sixty billion dollars

• repossessions are at the highest level since the Great Recession, meaning a real loss of mobility and often of employment for many households

For us this is a powerful signal. A car is one of the last things an American household is willing to give up. When the repayment breaks at this exact point, pressure in lower income groups has reached a critical level. And with time this stress always spills over into other areas of the economy, from discretionary consumption to credit sensitive sectors.

The chart shows the share of borrowers more than sixty days past due on their auto loans. Prime borrowers are people with strong credit scores and stable incomes, so their delinquency rate remains very low. Subprime borrowers have weaker credit profiles and less financial stability and their delinquency rate is rising to the highest levels ever recorded, close to seven percent. The chart clearly shows that the weaker part of the consumer base is under the greatest pressure.

Macroeconomic numbers look good at first glance. Unemployment is low, overall consumption holds and GDP does not signal a dramatic downturn. But the average masks the structure beneath.

There are two separate economies. One consists of higher income households with savings and assets that give them a greater tolerance for higher rates. The other consists of households with weak balance sheets where most of the income goes to rent or mortgage, utilities, groceries and debt payments.

For this second group used car loans are the first place where repayment starts to break, because it is a regular payment that cannot be delayed for long. This leads to clear consequences:

• less money for discretionary spending such as restaurants, fashion, holidays or non essential retail

• much higher sensitivity to any shock, such as illness or job loss

• tighter lending standards across banks and non bank lenders

• higher risk in parts of the high yield market connected to the weaker consumer

The fact that aggregate data still looks relatively healthy does not mean everything is fine. It simply means that the stress is concentrated in the lower income deciles, which is crucial information for politics, social stability and financial markets.

Credit cracks are not only being noticed by markets but also by banks. JPMorgan had to write off roughly one hundred seventy million dollars following the bankruptcy of the subprime auto dealer Tricolor. Another auto sector issuer, First Brands, fell into similar trouble.

Jamie Dimon addressed this directly on the earnings call. He said that when you see one cockroach there are usually more. According to him there may be other troubled loans hidden in the system, especially in private credit and non bank lending, where transparency is low and risk can accumulate much faster than in regulated banks.

This signal fits into the broader picture. If problems are emerging in a sector that is usually one of the last obligations households stop paying, it is likely that we are not at the end of the story but at the beginning of its visible phase.

This article is for information purposes only and does not constitute investment advice. Investing in financial markets involves risk and past performance is not a guarantee of future results.