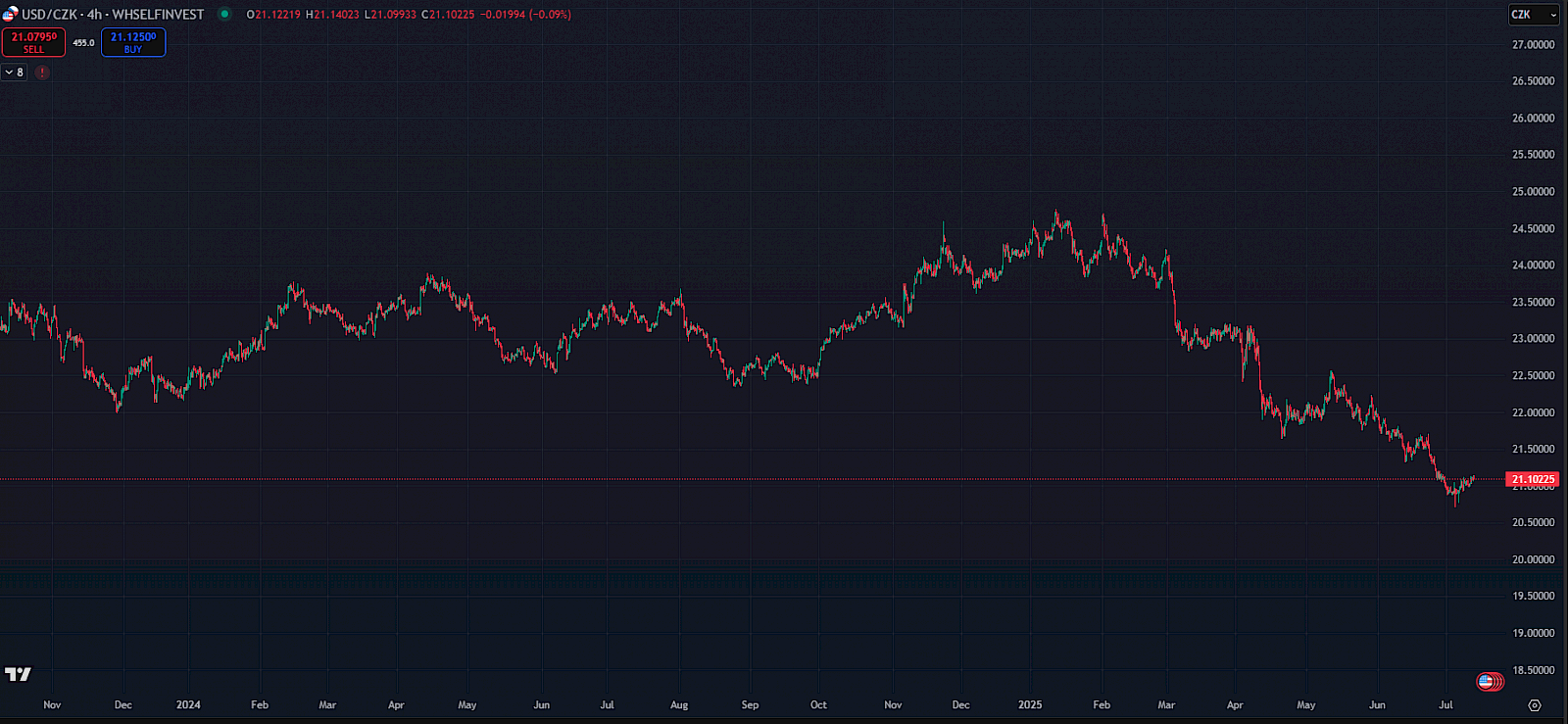

The dollar has just experienced one of its weakest years in the past 50. Against the Czech koruna, it has lost over 10%, and the USD/CZK currency pair has dropped from January levels around 23.3 down to the current 21.1.

We feel this development more acutely than usual in our portfolio. Our positions are mostly denominated in dollars, while client deposits come in Czech crowns. When the dollar weakens, it creates an FX loss that reduces the crown-denominated performance of the product—even though the dollar assets themselves may be rising. This is a purely currency effect – and it’s not unusual.

We’ve experienced similar developments many times in the past. For instance, in 2020 after the first wave of COVID, the dollar temporarily weakened against the crown, but by the end of the year, the exchange rate recovered and the overall crown return was positive. It was similar in 2017 or 2014. We view the current dollar weakening as temporary and expect this trend could completely reverse by year-end.

Chart: USD/CZK for 2024 from TradingView

Pressure on the dollar is coming from several directions. The U.S. Fed is beginning to mention possible rate cuts, while the Czech National Bank remains cautious. The koruna benefits from relatively high Czech interest rates, declining inflation, and a stable—albeit slow-growing—economy.

Conversely, the U.S. economy is slowing, and the market is beginning to reassess expectations, assuming the U.S. may need to loosen monetary policy sooner. The dollar is weakening globally as well—the U.S. Dollar Index (DXY) is down this year, and in some currency pairs, the drop is the largest in the past 10–15 years.

Elections in the Czech Republic could also become an important factor in the coming months. If the current opposition comes to power, investors may begin to price in a more aggressive fiscal expansion, potential euro ambitions, or other policy moves that could increase FX volatility. The market tends to reflect such uncertainty by weakening the koruna. And that’s precisely a scenario that would improve the FX effect for us—since a weaker crown would increase the crown value of our dollar positions.

On the USD/CZK chart, we’re observing a long-term downward trend. However, the RSI is showing a growing divergence, and the exchange rate is nearing the upper edge of the falling trendline. If this line is broken, there’s room for a return to the 22.5–23.5 range, where the market had long hovered in recent years.

Such a breakout would fundamentally change the existing trend and could lead to a rapid correction of part of the losses currently visible in crown terms. If the breakout is confirmed, we may see a return of part of the performance currently being muted by the exchange rate—within just a few weeks.

Chart: US Dollar Index from the TradingView community, showing the dollar at a breakout level supported by bullish divergence on the RSI.

The dollar has weakened in recent months, which has temporarily reduced the crown performance of our products. But there’s nothing unusual about this – we’ve seen similar cycles repeatedly. If the dollar bounces back—whether due to a shift in sentiment or political developments in the Czech Republic—a completely opposite trend could emerge. In that case, the USD/CZK rate could return to 22.5 or higher, contributing to additional appreciation.

This development is being closely monitored, and we are ready to adapt our tactics if the technical barrier at the 21.1–21.2 level is breached.

Note: This article is for informational purposes only and does not constitute investment advice. Investing in financial markets carries risks, and it is important to perform your own analysis before making any investment decisions.