The Biggest Short-Term Risk: A Supply Shock No One Is (Yet) Really Talking About

In recent weeks, we as an investment group have started closely monitoring the state of global trade – and we've come to a clear conclusion: the biggest short-term risk for markets today is not inflation, interest rates, or geopolitics, but a new supply shock.

What is a supply shock?

A supply shock refers to a sudden disruption in supply chains. The consequences typically include sharp increases in shipping costs, delayed deliveries, product shortages, and pressure on corporate margins. We witnessed this firsthand during the pandemic – and now, a second wave seems to be underway.

What are we monitoring?

We’re analyzing data from key nodes in global shipping – ports in the U.S. and China, trends in freight prices, container volumes, and the Dow Jones Transportation Index, which often leads the broader economy.

And the numbers are telling us something’s going on:

This is no longer a normal logistical fluctuation. This is systemic pressure on global supply.

Direct words from the port

Gene Seroka, Executive Director of the Port of Los Angeles, said in an April interview with Bloomberg:

“Typical shipments are now delayed by weeks to months. It will take the entire summer to fix the supply chain.”

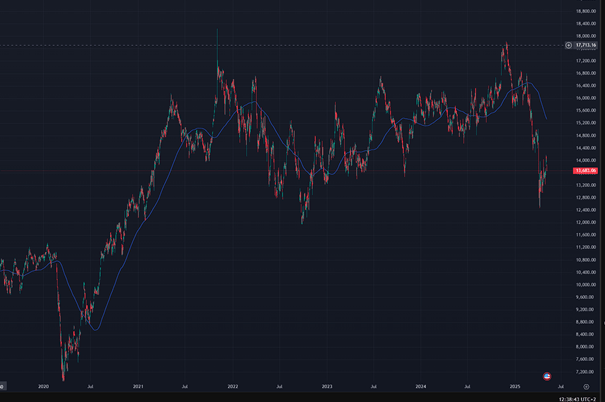

Dow Jones Transportation Index as a slowdown signal

Since March, the DJ Transportation Index has been trading in a range analysts describe as a “transportation recession.” In practice, this means demand for shipping is falling – a pattern that often signals an upcoming economic slowdown.

Companies are losing visibility – and pulling guidance

Besides logistics issues, there’s another layer of uncertainty: trade policy direction in the U.S. President Trump continues to shift rhetoric around new tariffs, often without detailed plans. For companies, this makes forward planning nearly impossible.

The result? Many are withdrawing or adjusting their full-year 2025 guidance.

Who has already pulled or changed their outlook?

These companies cover core sectors of the economy – industry, consumer goods, transportation, and tech. When they’re withdrawing guidance, it’s no coincidence.

So far, no one is really reacting to the risk of a supply shock. But in our view, this is the calm before the storm. For companies, it means margin pressure; for markets, volatility. It aligns with what we pointed out in our last article – markets are willfully ignoring negative signals. This often leads to irrational and overstretched valuations that don't reflect the actual environment. But usually only for a short while, until the market returns to rationality.

A real shift could come only with a concrete trade agreement between the U.S. and China – in that moment, the market will stop pricing in the present and start pricing in the future. A short-term demand shock? It won’t care anymore.

Note: This article is for informational purposes only and does not constitute investment advice. Investments in financial markets involve risks, and it's important to conduct your own analysis before making any investment decisions.