The Fed lowered interest rates by 25 basis points. It was an expected and very diplomatic move. Just enough to calm the markets, but not enough to send the message that the economy is in serious trouble. A larger cut was out of the question, because that would have clearly frightened investors. Instead, the Fed chose the middle ground, and it is highly likely we will see the same step in October.

Markets have already priced this in and are now waiting for the next wave of inflation and economic data.

The fact is, a quarter of U.S. states are already in recession according to the latest figures. The labor market is showing signs of weakness, and inflation is not coming down as the Fed would like. The small step taken now works as a mask, projecting stability on the outside while the underlying reality is much less favorable.

Another striking, and in a way amusing, development is happening in artificial intelligence. Nvidia purchased stakes in Intel and OpenAI, only for these players to turn around and buy Nvidia’s chips.

This doesn’t look entirely healthy. It resembles a ponzi-style loop – everyone supporting everyone else just to keep the wheel spinning. That already carries the marks of a bubble, whether people want to admit it or not. History shows us that such scenarios never ended softly, but with sharp unwinds.

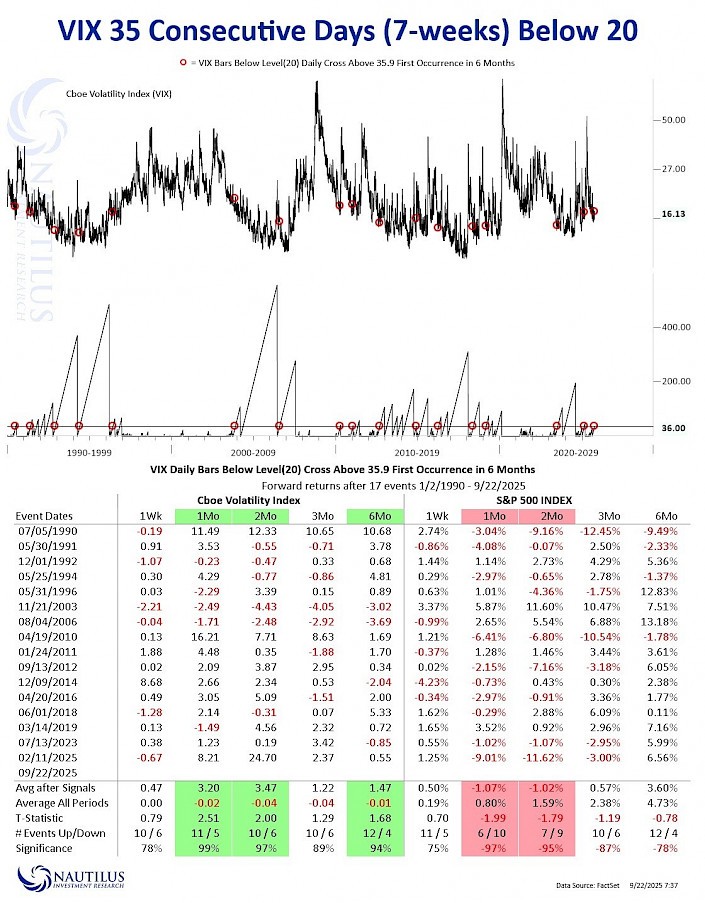

Our path remains defensive. And the recent development of the VIX confirms it. For more than 7 weeks the volatility index has stayed below 20, which historically often preceded heightened nervousness in the markets. In recent days we have also seen a situation where major indexes rose together with the VIX. That is not typical and usually signals that tension is building beneath the surface.

Another element is U.S. fiscal policy. In July, Congress approved an increase in the debt ceiling to postpone the risk of a government shutdown, but such solutions are only temporary. Even now, discussions are underway about whether the U.S. government could once again face difficulties in financing its operations. The probability of an immediate shutdown is small, but the very possibility shows that risks have not disappeared.

That is why we stick to our line: better to give up some short-term performance than to take risks in an environment where indicators and fiscal reality clearly show that risk is higher than it may first appear.

On the chart we see the development of the VIX, the volatility index that measures expected market fluctuations. The highlighted points mark situations when the VIX stayed below 20 for more than 35 consecutive days and then, within six months, spiked above 35.9.

Such periods of calm, when the VIX remains low for a long time, are often deceptive for markets. On the surface it looks safe, but history shows that precisely after these “quiet” phases a sharp rise in volatility and market anxiety often followed.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investing in financial markets involves risks. Always conduct your own analysis before making investment decisions.